Creditor Rights in Your Bankruptcy Case

Learn about the rights your creditors have under the Bankruptcy Code. After all, the Bankruptcy Code is a balancing act between your rights and those of your creditors.

How Are Creditors Treated in Bankruptcy?

11 U.S. Code § 507 and 11 U.S. Code § 1322

Creditors in Your Bankruptcy Case

Creditors and Claims

Creditors are the entities to whom you owe money.

More appropriately, in bankruptcy, creditors are the entities who hold (or have) “claims” against you for money.

NOTE. In bankruptcy the terms “creditor(s)” and “claim(s)” are used interchangeably.

Your creditors (i.e. their claims) may be treated differently by the Bankruptcy Code. In other words, the creditors may have different rights in your bankruptcy case.

The treatment (or the creditors’ rights) will be determined by the type of claims your creditors hold against you as well as the type of agreements you have with your creditors.

Think of the treatment as a hierarchy of importance — with the Bankruptcy Code favoring certain creditors over others.

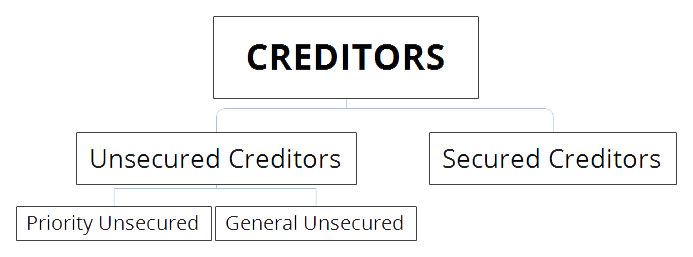

There are two categories of creditors: secured and unsecured

Creditors are divided into two categories.

The first consists of unsecured creditors. The second consists of secured creditors.

Unsecured creditors are subdivided into two subcategories: priority unsecured creditors and general unsecured creditors.

To truly distinguish between secured and unsecured creditors, you must understand two concepts: personal liability and security interest.

I discuss both below.

A super special class of creditors whose claims are not dischargeable

Finally, there’s a special class of claims that you may not be able to discharge in your bankruptcy case.

These claims are referred to as “nondischargeable.”

I incorporated nondischargeable claims into the discussion of unsecured creditors below.

Personal Liability: your promise to pay

Personal liability attaches to all your debts

“Personal liability” is your legally enforceable contractual obligation to pay back a debt to your creditor. This legal obligation is also know as your “promise to pay.” Think of it as a formal written “I OWE YOU” note or a verbal promise.

There are two forms of personal liability: personal liability by consent and personal liability by operation of law.

PERSONAL LIABILITY

by consent

Personal liability usually attaches between you and your creditor by agreement.

The agreement can be oral or in writing. Although usually, the agreement will be in writing.

If someone lends you money based on your promise to pay, personal liability attaches and you become legally obligated to your creditor for the debt.

The personal liability can be enforced in court and is easier to prove if it’s in writing.

PERSONAL LIABILITY

by operation of law

Personal liability can also attach by operation of law.

However, this generally applies to government creditors.

Some common examples are: income tax liability, child support, tickets and fines.

PERSONAL LIABILITY

is personal

Your promise to pay is a personal obligation. This means you are the only person a creditor can hold legally responsible for paying the debt.

Other individuals may be responsible for payment — typically a co-signer or a guarantor — but the responsibility of these individual’s will arise out of each individual’s respective promise to pay back the debt.

The bottom line is that generally a creditor can only seek payment (legally) from the person who is personally liable on the debt — i.e. the person who “promised to pay” the debt through an agreement or who the law holds accountable for payment.

ENFORCING

personal liability

Non-government creditors can only enforce your personal liability through the courts

Non-government creditors must take you to court and win to force you to pay a debt for which you are personally liable.

Without a court order, a creditor can only try to convince you or to pressure you into paying the debt. Creditors do this through the collection process.

In other words, without a court order a non-government creditor cannot take your property without your consent by, for example, garnishing your wages or freezing your bank account.

Government creditors can enforce you personal liability without going to court

Government creditors, however, can enforce your promise to pay be taking your property without taking you to court.

Here’s some common examples:

- The City of Chicago can suspend your driver’s license if you don’t pay your parking tickets

- The City of Chicago can seize your vehicle if you don’t pay your parking tickets.

- The City of Chicago can seize your state tax refund if you don’t pay your tickets.

- The IRS can freeze your bank accounts, garnish your wages, and put a lien on your home if you don’t pay your taxes.

- The government can recoup benefit overpayments by withholding a portion of your benefits.

The examples above have three things in common:

- The government is the creditor.

- Your personal liability attached by operation of law.

- The government is enforcing your personal liability without resorting to the courts.

SECURITY

interest

Security Interest: A Creditor’s License to Take Your Stuff

Think of the security interest as the creditor’s entitlement to your property. I like to refer to it as a license to take your stuff.

For bankruptcy purposes, security interests come in two varieties: the consensual security interest and the non-consensual security interest we will refer to as a lien.

Each is discussed in depth below.

you agreed the creditor can take (the “collateral”) if you default on the loan. Most commonly, the security interest arises by a written agreement between you and your creditor. But it can also arise involuntarily by operation of law or through the courts — this is referred to as a lien.

VOLUNTARY

security interests

Security Interest by Agreement

The security interest that arises by agreement is the most common type of security interest.

The agreement must be in writing between you and your creditor. The agreement gives the creditor permission to take certain property you pledge as “collateral” if you default on the loan. Because the creditor can be legally entitle to your stuff if certain conditions are met, the security interest is a form of property interest.

Generally, the security agreement is executed at the same time you execute the contract for the loan (the contract is your promise to pay and makes you personally liable on the loan). And the act of giving the creditor a security interest is referred to as a “secured transaction.”

Generally, in the consumer context, the security interest will only attach to the property you are purchasing with the money you are borrowing from the creditor — think car loan or mortgage (which are probably the most common types of secured transactions).

The security interest serves as added protection to a creditor extending the loan beyond your personal liability (i.e. your promise to pay back the loan).

In bankruptcy, the creditor holding a security interest is referred to as a “secured creditor” holding a “secured claim.”

One very important aspect about security interests is that in bankruptcy, with certain few exceptions, security interests ride thru unaffected; i.e. they are not eliminated.

This means that unless an exception applies, the creditor will still have a license to take your stuff even after your bankruptcy case is over.

INVOLUNTARY

security interests

Security Interest You Did Not Agree To

Creditors may also obtain security interests in your property without your consent.

This form of a security interest is more appropriately referred to as a “lien.” I am lumping the lien with the traditional voluntary security interest because the lien is also a form of a property interest in your stuff and receives similar treatment in bankruptcy as the voluntary security interest — albeit with less protection.

Nonconsensual liens against your property can arise in two ways: by operation of law and by the use of courts.

I discuss each in turn below.

Non-consensual Liens by Operation of Law

Liens by operation of law arise on debts owed to government creditors — think the IRS tax lien.

Federal, state, or municipal law gives these creditors the power to place liens on your property when certain conditions are satisfied. Because these liens derive from statutes, they are referred to as “statutory liens”.

Statutory liens may attach to some or all of your property.

For example, if you don’t pay your federal taxes on time, the IRS may record a Notice of Tax Lien with the county recorder and the lien will attach to all of your property.

In bankruptcy, government creditors with statutory liens have a property interest in your property and are treated as secured creditors.

Non-consensual Liens by Court Order

Ordinary creditors (i.e. non-government creditors) can also attach liens to your property without your consent, but they must do so through the use of courts.

This means that the creditor must first sue you in court by filing a lawsuit and then win a judgment against you (i.e. a court order).

Once the creditor obtains a judgment against you, that creditor becomes a “judgment creditor.”

The judgment creditor can then use the judgment to obtain 3 kinds of non-consensual liens:

- a wage garnishment (a lien on your wages)

- a citation to discover assets (a lien on your personal property)

- and a judgment or judicial lien (a lien on your real estate) by recording the judgment with the county recorder of deeds

In bankruptcy, creditors with non-consensual liens are also considered secured creditors as they have entitlements to your property.

Unlike consensual security interests however, in certain situations, non-consensual security interests (i.e. liens) can be eliminated in bankruptcy through the use of exemptions.

Need help or have questions? Contact Arthur Corbin.

CREDITOR

categories

Secured and Unsecured Creditors Explained

If you read about personal liability and security interests above, you will be able to easily distinguish between secured and unsecured creditors.

Each category is discussed below.

WHAT ARE

unsecured creditors?

Unsecured Creditors Explained

Unsecured creditors are creditors to whom you agreed to be personally liable on the money you borrowed but to whom you did not agree to give a security interest.

Unsecured creditors can only take your property by filing a lawsuit, obtaining a judgment, and then using the courts to enforce that judgment.

Because filing lawsuits and obtaining judgments is time consuming and expensive, these creditors usually resort to collections actions to get you to pay before filing a lawsuit.

There are two sub-categories of unsecured creditors:

- General unsecured creditors, and

- Priority unsecured creditors

Each sub-category is discussed below.

General Unsecured Creditors (GUCs)

General unsecured creditors are very easily dealt with in bankruptcy because the Bankruptcy Code — whether chapter 7 or chapter 13 — discharges your personal liability on the debts you owe to these creditors.

In other words, your bankruptcy discharge destroys your legal obligation to pay the debts you owe to general unsecured creditors — the contract is void.

Accordingly, after you receive your bankruptcy discharge, a general unsecured creditor cannot take you to court because the legally enforceable promise to pay no longer exists.

Priority creditors are are also unsecured creditors, but with one very important difference:

For public policy reasons, the Bankruptcy Code, gives special treatment to these creditors.

This means that priority claims will not be discharged in chapter 7 and you will still be responsible for the debts to these guys after your case is over.

This also means that if you file chapter 13, you will need to pay these creditors in full through your chapter 13 plan.

You’ll find examples of the most common general unsecured creditors and the most common priority creditors below.

MOST COMMON

unsecured creditors

These are the most common unsecured creditors in the consumer context.

General

Priority

Non-Dischargeable

General

- Credit Cards

- Medical Bills

- Payday Loans

- Personal Loans (online, bank or credit union, family, friends)

- Utility, Cable, Cellphone Bills

- Repossession Deficiency

- Car Accident Claims

- Business Debts

- Benefit Overpayments (e.g. Social Security, Unemployment, VA) (but see non-dischargeable tab )

- Lawsuit Judgments

- Eviction/Past Due Rent

- Attorney’s Fees

- Bounced Checks

- Student Loans(but see non-dischargeable tab)

Priority

The most common consumer priority creditors are listed below. They are also listed in the Bankruptcy Code’s order of priority.

The order of priority dictates which creditors must have their claims paid in full before funds are paid to the creditors lower in the hierarchy.

The order of priority applies to chapter 7 liquidation and to chapter 13 plan disbursements.

- Domestic Support Obligations (e.g. child support, alimony, etc.) (also see non-dischargeable below )

- Certain Unpaid Income Taxes

- Car Accident Death or Injury (operating while intoxicated)

Non-Dischargeable

Below, are the most common unsecured debts, with some exceptions, that will not be discharged in your bankruptcy case.

Note that some debts that are not dischargeable in chapter 7 can be discharged in chapter 13.

Debts automatically not dischargeable in chapter 7

- Domestic Support Obligations of Any Kind(e.g. child support, alimony, etc.)

- Certain Income Taxes and Payroll Taxes

-

Car Accident Death or Injury to Person or Property

(operating while intoxicated) -

Student Loans

(unless you file an adversary proceeding and prove undue hardship)

-

Civil Fines

(including PARKING TICKETS, red light and speed camera violations) -

Criminal Fines and Restitution

(including traffic tickets) - Certain Debts You Failed to Disclose

Debts a creditor must prove are not dischargeable

To prove non-dischargeability, the creditor must file an adversary proceeding (a lawsuit) inside your bankruptcy case.

-

Any Debt Incurred by Fraud

(creditor must establish fraud) -

Debts Incurred by Willful or Malicious Injury

(creditor must establish willfull and malicious)

Non-Dischargeable debts that ARE DISCHARGED in chapter 13

-

Debts Arising Out of Willful or Malicious Injury to Property

(creditor must establish willfull and malicious) -

Civil Fines

(including PARKING TICKETS, red light and speed camera violations) - Certain Debts Incurred in a Divorce

WHAT ARE

secured creditors?

Secured Creditors Explained

Secured creditors are creditors who have a security interest (discussed above) in your property (collateral) in addition to you being personally liable on the debt.

So, secured creditors have two things:

- They have your personal liability on the debt, and

- They have a security interest in your property.

As discussed above, the bankruptcy discharge will eliminate your personal liability on most debts.

What the bankruptcy discharge will not do, however, is eliminate the security interest.

I discuss what this means under chapter 7 and under chapter 13 below.

Secured creditors and chapter 7

This is what happens to secured debts in chapter 7.

First: your personal liability will be discharged

The chapter 7 will discharge your personal liability on the debt you owe to the secured creditor.

This means that the secured creditor will no longer be able to enforce the debt and you will not longer be legally obligated to pay it back.

In other words, chapter 7 will eliminate the secured debt just like it eliminates the general unsecured debt — your promise to pay is destroyed by the chapter 7 discharge.

Second: the security interest remains unaffected

The chapter 7 will not eliminate the creditor’s security interest in the collateral (i.e. the creditor’s right to take the property securing the debt).

This is because the chapter 7 discharge only eliminates your personal liability on the debt (your contractual promise to pay).

Chapter 7 does not eliminate security interests creditors have obtained in your property prior to you filing the case (there are some exceptions but they are usually not applicable and will not be discussed here) because security interests are property interests; they are not debts.

However, in chapter 7, the Bankruptcy Code requires you to give notice to all parties about what you intend to do with the security interest.

The Bankruptcy Code also requires you to execute your intention during a specified period of time.

To give notice, you must compete and file a Statement of Intention.

The Statement of Intention gives you 4 options to deal with the security interest:

First, you can elect to dispose of the security interest by surrendering (returning) the collateral to the creditor.

Second, you can elect to redeem the collateral.

Third, you can reaffirm the security interest.

Fourth, you can elect to keep the collateral and continue to make installment payments without reaffirming or redeeming. This is called the “pay and maintain” option.

Each option has its consequences and should be made with advice of counsel.

Secured creditors and chapter 13

Secured creditors in chapter 13 can be dealt with in three ways.

First, if you are current on your payments to the secured creditor, you can continue making the payments directly to the creditor as you have been doing.

Second, if you are behind on your payments to the secured creditor, you can cure the past due amount through your chapter 13 plan:

- If the debt is a mortgage, you can pay the past due amount through the chapter 13 plan and either make current mortgage payments yourself outside of the plan or elect to have the chapter 13 trustee make the payments for you.

- If the debt is secured by personal property (e.g. a car loan or a furniture loan), you will have to pay the balance of the secured debt, or in some cases only the value of the collateral, with interest through your chapter 13 plan.

Third, you can surrender (return) the collateral to the creditor and treat the deficiency (a deficiency is the remaining balance you will owe to your creditor if the creditor sells the surrendered property for less than the balance owed) as a general unsecured debt.

MOST COMMON

secured creditors

These are the most common secured creditors in the consumer context

- Car Creditors

- Mortgage Creditors

- Household Items (e.g. furniture, electronics)